Opportunity Zone Program in Columbus

Opportunity Zone Census Tracts

As an Investor:

If you are investing in a property or business in an Opportunity Zone, the program offers three main benefits:

- A temporary tax deferral for capital gains reinvested in an Opportunity Fund.

- A step-up in basis for capital gains reinvested in an Opportunity Fund:

- 10% basis increase if the investment is held for at least 5 years and 15% if held for at least 7 years.

- A permanent exclusion from taxable income of capital gains from the sale or exchange of a qualified fund investment if it is held for at least 10 years.

For more information on Opportunity Zones in Columbus, please contact:

Mandy Mallott

Business Development Specialist

City of Columbus, Department of Development

[email protected]

Mark Lundine

Economic Development Administrator

City of Columbus, Department of Development

[email protected]

What are Opportunity Zones?

Qualified Opportunity Zones are a new community development program established by Congress in the Tax Cuts and Jobs Act of 2017. This program encourages new, long-term investment in property or businesses in specific areas around the City through federal tax incentives for investors. To take advantage of the program, investors must reinvest new capital gains into Qualified Opportunity Funds which are spent in Qualified Opportunity Zones.

What are capital gains?

A capital gain happens when you sell something for more than you bought it for. Buy a used car for $1,000 and sell it for $2,000 a week later, and you have a $1,000 capital gain—same as if you bought stock for $1,000 and sold it for $2,000. Just about everything you or a company owns qualifies as a capital asset that could create a capital gain— whether it as an investment, such as stocks or property, or was bought for personal or company use, such as a car or a big-screen TV.

How do investors invest in an Opportunity Zone and what are Qualified Opportunity Funds?

Investments in Opportunity Zones must be made through Qualified Opportunity Funds. There are very few limitations on what kinds of organizations can create and manage an Opportunity Fund, though it must be created as either a partnership or a corporation, and the Fund must be established and managed according to regulations created by the United States Department of Treasury.

Are there Qualified Opportunity Zones in Columbus?

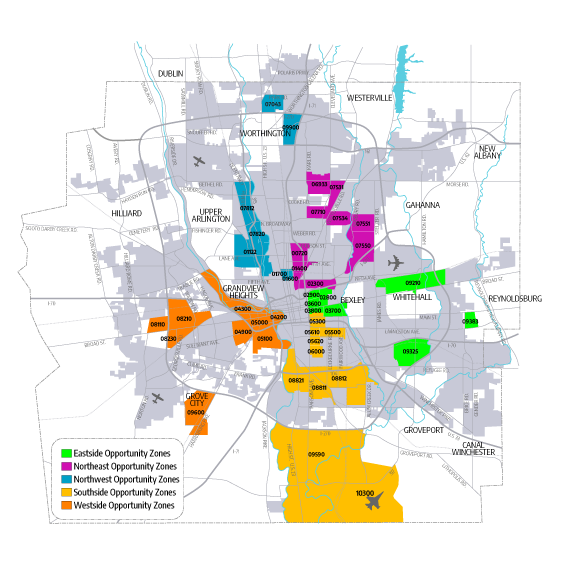

There are 44 approved Qualified Opportunity Zones in Franklin County, 39 of which are solely located in the City of Columbus, focused in 5 areas:

- Eastside Opportunity Zones: Includes parts of Whitehall along Broad Street, the Brice and Main Corridor in Reynoldsburg, the Eastland Mall area, Mt. Vernon, King-Lincoln District, Olde Towne East, Near East Side, and Franklin Park.

- Northeast Opportunity Zones: Includes parts of Milo-Grogan, Devon Triangle, the Cleveland Avenue Corridor (South Lindon, Northern Lights area, Walnut Creek, and the Cleveland and Morse area), Framingham, Cumberland Ridge, and Bridgeview.

- Northwest Opportunity Zones: Includes parts of Crosswoods, The Continent, and West Campus.

- Westside Opportunity Zones: Includes parts of the Scioto Peninsula, Franklinton, South and Central Hilltop, Valleyview Heights, Consumer Square West, Westland Mall, and Lincoln Village.

- Southside Opportunity Zones: Includes parts of the Rickenbacker area, 270/23/Alum Creek Drive area, Route 104 Industrial Corridor, and the East Parsons Avenue Corridor.

The Opportunity Zone map shows the location of these zones, and you can search for your specific address at https://www.cims.cdfifund.gov/preparation/?config=config_nmtc.xml.

How do Qualified Opportunity Funds benefit Opportunity Zones?

At least 90% of the money placed in Qualified Opportunity Funds must be spent in Opportunity Zones, and can be invested in operating businesses, equipment, and real estate. The Funds will not provide direct grants but could provide repayable loans or equity investments to projects located in a Zone. Funds have the potential to direct financing to areas of Columbus where it can otherwise be challenging to access traditional capital.

What does the Opportunity Zone Program mean for me?

As a Business Owner:

If you are a business owner currently in an Opportunity Zone or thinking about relocating to one, the program provides two major benefits:

- Attracting Investors – Your location offers potential investors significant tax incentives for investing in your business through Qualified Opportunity Funds, for example, as a repayable loan to purchase new machinery or a long-term equity investment for a share of your business. Whether you chose to set up a Fund, talk to existing investors, or approach other Funds, the program increases the marketability of your business to attract new capital.

- Investing in Yourself – If, as a business owner, you or your company has new capital gains, the program and Qualified Opportunity Funds provide a chance to earn the federal tax incentives while making needed investments in your business.

As a Property Owner:

If you are a property owner currently in an Opportunity Zone, the program increases the marketability of your property. Whether it is an investor looking to purchase your house or land, or a business interested in leasing space in your building, this program offers significant benefits you should be aware of:

- Investors – For the person or company looking to purchase your property, they are able to gain the federal tax benefits by making the purchase through a Qualified Opportunity Fund, increasing the value of the investment in your property.

- Tenants – For the business interested in leasing space from you, they are able to attract and make investments from Funds due to their location in an Opportunity Zone, increasing the marketability of their business.