The City of Columbus is committed to helping companies find appropriate facilities for doing business in the city. The Economic Development Division can access and search a comprehensive site and building inventory database, which includes office suites, buildings, and properties that are currently available for sale or lease.

The Division can create custom-tailored reports for users that have specific project parameters or requirements using this resource. The services of the Division are available at no cost to the user.

For more information on site selection in Columbus, please contact:

Abby Falcone

Business Development Specialist

City of Columbus, Department of Development

[email protected]

COLUMBUS METRO AREA MAP

The Columbus metropolitan area consists of the counties of Franklin, Delaware, Licking, Madison, Pickaway and Fairfield. Current population estimate is approximately 1.8 million people.

Proximity

Located within 500 miles of New York, Washington D.C., Chicago, Atlanta and other important locations, our regional access to major population centers of the United States gives the city a distinct advantage to travelers and distribution operations.

More than 15,000 truck movements originate or terminate daily in Greater Columbus. Over 160 direct flights are available from John Glenn Columbus International Airport and Rickenbacker International Airport has a foreign trade zone and numerous warehouse options.

Columbus freeways include I-71, I-70 (a major east-west interstate), I-270 and I-670. It is also one hour from Interstate 75, which serves markets such as Detroit, Cincinnati, Atlanta and Miami.

Commute time in Columbus averages slightly over 20 minutes, one of the best nationwide.

Columbus is at the crossroads of interstate highways I-70 and I-71, connecting to the Interstate grid. The area has more than 140 trucking companies, 30 of which offer nationwide service.

Proximity by Air

Columbus is served by Port Columbus International Airport, which currently offers over 150 non-stop flights to 33 cities. Eleven major carriers provide direct flights to locations such as Atlanta, Chicago, New York, Miami and Las Vegas. Close to many population centers in the eastern United States, Columbus is a major logistics and distribution location.

Rickenbacker International Airport is an international multi-modal cargo airport, a charter passenger terminal and offers a foreign trade zone for international cargo.

For more information visit columbusairports.com.Each ring is 500 miles or one hour travel by air.

Transportation by Rail Map

Columbus' excellent location allows the city to be a major logistics and distribution center. The region has access to excellent rail and air service, making Columbus your best option for distribution.

Industrial Parks

1 Westbelt Business Park

2 CityGate Business Park

3 Columbus International Air Center

4 Southwest Airport Industrial Park

5 Lockbourne Industrial Park

6 Opus Business Center at Rickenbacker

7 Rickenbacker Global Logistics Park

8 Rickenbacker Air Industrial Park

Fortune 1000 Companies

Columbus is headquarters to at least 20 Fortune 1000 companies. In addition, firms such as NetJets, Chase, Kroger, Anheuser-Busch and many others have major facilities in the area.

Employment by Sector

Columbus Region Largest Employers

| Company | FTE |

| Abbott Nutrition | 2,055 |

| Abercrombie & Fitch | 2,598 |

| Accenture | 750 |

| Aetna | 1,245 |

| Alliance Data | 3,000 |

| Amazon | 4,828 |

| American Electric Power

Company | 3,627 |

| Anthem Blue Cross and Blue

Shield | 900 |

| Ascena Retail Group | 1,635 |

| Battelle | 1,636 |

| Big Lots | 1,133 |

| Cardinal Health | 5,075 |

| Cardington Yutaka Technologies | 725 |

| CareWorks MCO / York Risk Services | 1,435 |

| CAS | 1,400 |

| Columbia Gas of Ohio | 1,027 |

| Designer Brands | 1,092 |

| DHL | 2,192 |

| Discover | 2,283 |

| Eddie Bauer | 900 |

| Express | 757 |

| Express Scripts | 1,271 |

| FedEx | 1,044 |

| Fifth Third Bank | 702 |

| Fiserv | 1,000 |

| Gap | 1,508 |

| Grange Insurance | 929 |

| Hikma | 1,026 |

| Honda | 11,077 |

| Huntington | 4,921 |

| IBM | 970 |

| JPMorgan Chase | 20,316 |

| L Brands | 7,662 |

| Lancaster Colony Corporation | 892 |

| Mars Petcare | 836 |

| Mettler-Toledo | 800 |

| Nationwide | 12,862 |

| NetJets Inc. | 1,300 |

| Owens Corning | 1,000 |

| PNC Financial Services | 1,500 |

| Safelite | 2,551 |

| Scotts Miracle-Gro | 1,100 |

| Spectrum | 2,000 |

| Stanley Electric | 1,385 |

| State Auto Insurance Companies | 876 |

| State Farm Insurance | 1,400 |

| Teleperformance | 1,730 |

| TS Tech | 1,789 |

| UnitedHealth | 1,900 |

| UPS | 1,669 |

| Verizon | 1,300 |

| Whirlpool Corporation | 2,519 |

| Worthington Industries | 1,625 |

| XPO Logistics | 2,246 |

| zulily | 1,446 |

Source: One Columbus, economic base employment, 2019

One location in Columbus

Colleges and Universities

Columbus offers many opportunities for higher education. We're home to The Ohio State University, one of the largest universities in the nation. Capital, Otterbein and Franklin Universities provide quality private educations on a smaller scale. And Technical, medical and other choices, such as Columbus State Community College, add to the possibilities for students of all ages.

Interactive Map

View Larger Map

Quality of Life In Columbus

Columbus is the 14th largest city in the United States with a population of 879,170. The city is perfect for active lifestyles, having invested $20 million to develop a growing system of bike and fitness trails that connect the suburbs and river trails to downtown's $44 million riverfront park system restoration.

Columbus is gaining nationwide recognition for its historic neighborhoods, booming downtown arts and sporting districts, open attitude and a noticeably affordable quality of life.

Neighborhoods

Columbus offers a variety of housing options-from the restored historic German Village, the Short North district, downtown condominiums, and new neighborhoods popping up around the city.

Shopping & entertainment

Shopping, entertainment and fine dining include the Arena District, Easton Town Center, Polaris Fashion Place and Tuttle Mall.

.jpg)

Sports

The NHL Columbus Blue Jackets, the Columbus Crew, the Ohio State Buckeyes and the Columbus Clippers are among the many choices for the sports enthusiast. Numerous fine golf courses are in the region. The area is also home to the Memorial Golf Tournament each summer.

Rankings

Museums, festivals, parks, live music and theatre are just some of the reasons Columbus is one of the best places in the nation to live, work and raise a family. But don't take our word for it. Here's where we rank according to some of the top news sources around the nation.

14thmost populous city in the U.S., https://www.census.gov

#1 real estate market in US, https://www.columbusunderground.com

Top 20 best US cities for startups, https://www.commercialcafe.com

#1 city for tech jobs, www.lendingtree.com

#3 best city for new grads to live, work, play, https://www.realtor.com/

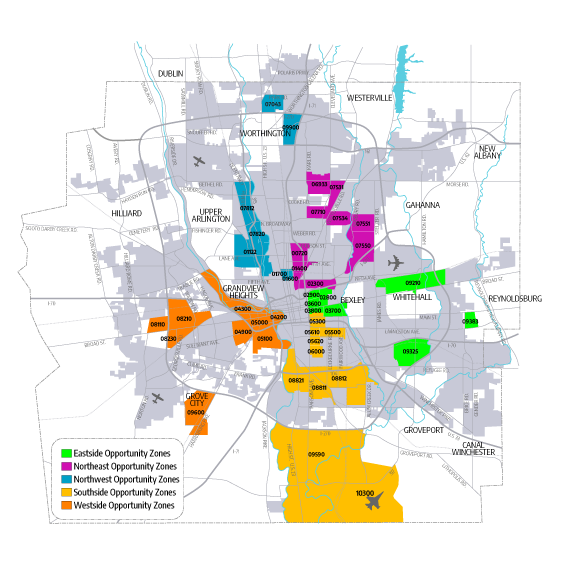

Opportunity Zone Program in Columbus

Opportunity Zone Census Tracts

What are Opportunity Zones?

Qualified Opportunity Zones are a new community development program established by Congress in the Tax Cuts and Jobs Act of 2017. This program encourages new, long-term investment in property or businesses in specific areas around the City through federal tax incentives for investors. To take advantage of the program, investors must reinvest new capital gains into Qualified Opportunity Funds which are spent in Qualified Opportunity Zones.

What are capital gains?

A capital gain happens when you sell something for more than you bought it for. Buy a used car for $1,000 and sell it for $2,000 a week later, and you have a $1,000 capital gain—same as if you bought stock for $1,000 and sold it for $2,000. Just about everything you or a company owns qualifies as a capital asset that could create a capital gain— whether it as an investment, such as stocks or property, or was bought for personal or company use, such as a car or a big-screen TV.

How do investors invest in an Opportunity Zone and what are Qualified Opportunity Funds?

Investments in Opportunity Zones must be made through Qualified Opportunity Funds. There are very few limitations on what kinds of organizations can create and manage an Opportunity Fund, though it must be created as either a partnership or a corporation, and the Fund must be established and managed according to regulations created by the United States Department of Treasury.

What does the Opportunity Zone Program mean for me?

As a Business Owner:

If you are a business owner currently in an Opportunity Zone or thinking about relocating to one, the program provides two major benefits:

Attracting Investors – Your location offers potential investors significant tax incentives for investing in your business through Qualified Opportunity Funds, for example, as a repayable loan to purchase new machinery or a long-term equity investment for a share of your business. Whether you chose to set up a Fund, talk to existing investors, or approach other Funds, the program increases the marketability of your business to attract new capital.

Investing in Yourself – If, as a business owner, you or your company has new capital gains, the program and Qualified Opportunity Funds provide a chance to earn the federal tax incentives while making needed investments in your business.

As a Property Owner:

If you are a property owner currently in an Opportunity Zone, the program increases the marketability of your property. Whether it is an investor looking to purchase your house or land, or a business interested in leasing space in your building, this program offers significant benefits you should be aware of:

Investors – For the person or company looking to purchase your property, they are able to gain the federal tax benefits by making the purchase through a Qualified Opportunity Fund, increasing the value of the investment in your property.

Tenants – For the business interested in leasing space from you, they are able to attract and make investments from Funds due to their location in an Opportunity Zone, increasing the marketability of their business.

As an Investor:

If you are investing in a property or business in an Opportunity Zone, the program offers three main benefits:

• A temporary tax deferral for capital gains reinvested in an Opportunity Fund.

• A step-up in basis for capital gains reinvested in an Opportunity Fund:

• 10% basis increase if the investment is held for at least 5 years and 15% if held for at least 7 years.

• A permanent exclusion from taxable income of capital gains from the sale or exchange of a qualified fund investment if it is held for at least 10 years.

For more information on Opportunity Zones in Columbus, please contact:

Mark Lundine

Economic Development Administrator

City of Columbus, Department of Development

[email protected]